If you’re new to driving or returning after a break, the world of car ownership might seem filled with unfamiliar terms and phrases.

- What is a vehicle log book?

- How do I get a vehicle log book?

- When would I need a vehicle log book?

- Updating personal information and changes to vehicle

- How do I apply for a new one?

- Frequently asked questions

One common question is, “What’s this ‘vehicle log book’ everyone talks about?” Officially known as the V5C, this document has several key roles in the world of vehicle ownership. It’s crucial to get a grip on what it is and when you’ll need it.

In this guide, we’ll break down the essentials of the vehicle log book, when you might require it, how to get a replacement and more.

What is a vehicle log book?

The vehicle log book, known in official circles as the V5C registration certificate, is an essential document that identifies the registered keeper of a vehicle. This isn’t just a basic form; it’s a comprehensive record brimming with crucial details.

At its core, the log book contains personal information like your name and address. But it delves deeper, listing aspects of the vehicle such as its registration number, make, model, modifications made, previous registered keepers, its colour, engine size, and even its emission levels.

Now, you might be thinking, “When would I need this?” Well, there are a variety of scenarios:

- Updating Personal Details: If there’s a change in your name or address, it’s your responsibility to notify the DVLA. The vehicle log book is a key instrument in this process.

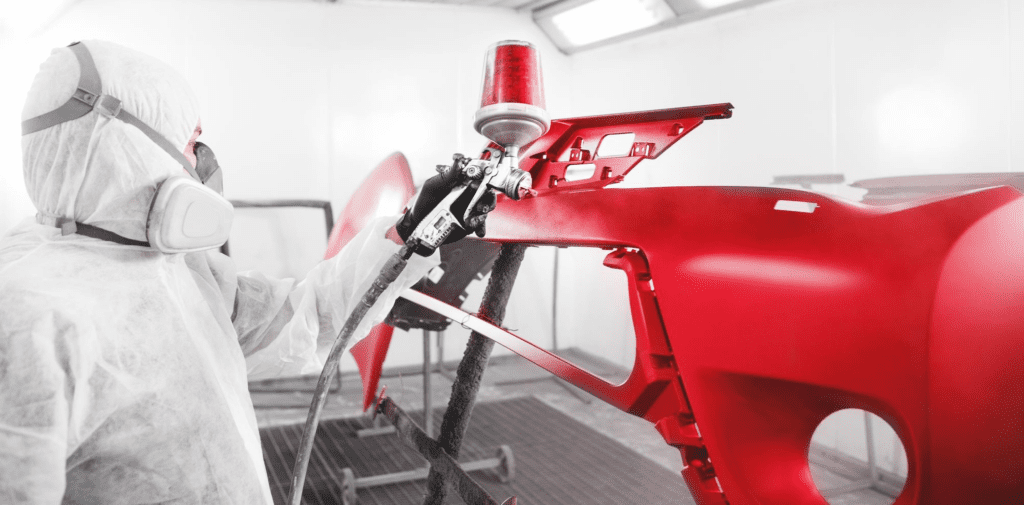

- Vehicle Modifications: If you decide to customise your car, maybe by giving it a new paint job or upgrading its engine, you’ll need the V5C to update these details.

- Declaring a SORN: If you’re taking your vehicle off the road, applying for a Statutory Off Road Notification requires this document.

- Scrapping or Selling: When bidding farewell to your car, whether selling or scrapping, the vehicle log book comes into play to ensure the transition process runs smoothly.

- Taxing Your Vehicle: Before you hit the road, ensuring your vehicle is taxed is a must, and yes, you’ll need the V5C for this too.

However, an essential point to remember is that possessing a vehicle log book doesn’t mean you are the outright owner of the car.

It simply establishes that you are the registered keeper. Ownership might be with someone else, especially if the vehicle is on finance or leased.

Who is the registered keeper?

Navigating the world of car documentation, two terms often arise: the owner and the registered keeper. While they may sound interchangeable, they serve distinct roles.

Vehicle Owner: This title belongs to the individual or entity who has purchased the vehicle. They hold the financial rights to the vehicle and often possess a physical proof of purchase or an ownership document. Remember, the V5C or vehicle log book doesn’t count as this proof.

Registered Keeper: This is the person designated to use and look after the vehicle. They’re the ones who tax the vehicle, ensuring it complies with legal obligations, and they’re also the usual recipients of any parking tickets, fines, or other road-related charges. The car might sit on their driveway, they might drive it daily, but that doesn’t necessarily mean they own it.

You might ask, “Why differentiate between the two?” Well, there are practical instances where these roles diverge:

-

Company Cars: When you’re driving a company car, the actual vehicle ownership lies with the company or the leasing agency. They’re responsible for its acquisition, and they hold the ownership rights. However, if you, as an employee, are the primary user of this vehicle, you become the registered keeper, responsible for its day-to-day management.

-

Gifted or Loaned Vehicles: Consider a teenager who’s gifted a car by their parents for a birthday or graduation. The parents, having bought the car, are its owners. However, the teenager, who will be driving, maintaining, and parking the vehicle, becomes the registered keeper.

-

Cars on Finance: If you’ve purchased a vehicle through a finance deal, until that finance is fully paid off, the finance company might retain ownership of the car. You, however, as the primary user, remain its registered keeper.

The distinction is vital not just for paperwork, but for understanding responsibilities and rights. As a registered keeper, you might bear the responsibilities of maintenance and fines, but ownership rights, especially when selling or major modifications are concerned, belong to the vehicle’s owner.

How do I get a vehicle log book?

The vehicle log book, also referred to as the V5C registration certificate, is a critical document that registers a vehicle under your name. It encompasses various details from the owner’s name and address to specifics about the vehicle itself. Here’s how to ensure you get one:

- Brand New Vehicles: When you purchase a vehicle straight off the showroom floor, the dealership usually handles the registration process on your behalf. Following the registration, you should anticipate the arrival of your vehicle log book via post within 6 weeks. If, for some reason, the dealership doesn’t undertake this responsibility, don’t fret! The onus is then on you to register your gleaming new car with the DVLA.

- Pre-owned Vehicles: The dynamics change slightly when buying a used vehicle. Typically, the seller takes the initiative to register the vehicle under the new buyer’s name. This can be achieved online, ensuring a swift transition, or done the traditional way through postal means. Either way, the goal is to ensure that the vehicle’s log book reflects the correct, current keeper.

A Cautionary Note: The DVLA strongly advises prospective buyers to tread with caution. Before finalising any purchase, always ensure that the vehicle is accompanied by its legitimate log book. Some unsavoury sellers have been known to forge or tamper with these documents, trying to pass off counterfeit versions as genuine. To counter this, the DVLA provides specific guidelines and verification methods to help you discern an authentic V5C from a dubious one.

Moreover, should you misplace or damage your vehicle log book, or if it never arrives, it’s essential to apply for a replacement through the DVLA promptly. The process involves filling out specific forms and may be subject to a fee.

This ensures continuity in the documentation and smoothens out any administrative processes you might encounter in the future, such as selling the vehicle or making modifications.

How to check your log book is authentic

The Vehicle Log Book (V5C) is a crucial document, and it’s essential to guarantee its authenticity, especially when purchasing a pre-owned vehicle. Here’s a comprehensive guide to validate the legitimacy of a V5C:

- DVLA Watermark Verification: Begin by examining the document for the official DVLA watermark. By holding the log book against a light source, the watermark should be clearly discernible.

- Consistency of Registered Keeper’s Details: The name stated under the ‘registered keeper’ section should ideally match the individual selling you the vehicle. Discrepancies here could be a red flag.

- Address Verification: The address of the person selling you the vehicle should be consistent with the one mentioned in the log book. Inconsistencies might indicate potential issues.

- Serial Number Scrutiny: Pay close attention to the serial number featured in the log book. If it falls within the range of BG8229501 to BG9999030 or BI2305501 to BI2800000, proceed with caution. These series are known to be associated with stolen V5Cs. If you come across these numbers, it’s prudent to inform the local authorities immediately.

- Vehicle Details Matching: Dive deeper by matching the vehicle identification number (VIN) and the engine number with the details documented in the log book. Discrepancies here could mean the log book doesn’t belong to the vehicle in question or has been tampered with.

- Paper Quality and Print: Genuine V5Cs are printed on high-quality paper. Assess the paper quality and ensure the print doesn’t look smudged or hastily done, which could be signs of forgery.

- Seek Expert Advice: If in doubt, consider seeking expert guidance, perhaps from a reputable car dealer or a trusted mechanic. They might spot anomalies that are easy to overlook for the untrained eye.

Remember, purchasing a vehicle with a forged or tampered log book could lead to legal complications down the line. Always ensure the authenticity of the V5C for a hassle-free ownership experience.

When would I need a vehicle log book?

Understanding when you might need to pull out your vehicle log book (V5C) is essential. Whether you’re selling, scrapping, or registering your car off-road, your V5C is often central to the process.

Let’s delve into the various scenarios when you’ll require this crucial document.

Selling Your Vehicle

When selling your car, the 11-digit reference number in the vehicle log book is crucial. The buyer should receive the green ‘new keeper’ slip from the V5C. After completing the sale, notifying the DVLA is a must.

Once confirmed, you’ll get an email and letter from the DVLA declaring that the vehicle’s registered keeper is no longer you. If any vehicle tax is outstanding, you might also receive a refund cheque.

The new keeper should expect an email confirmation and a fresh log book within about five working days.

Scrapping Your Vehicle

Considering scrapping your car? Inform the DVLA; failing to do so might land you with a fine up to £1,000. Using the V5C simplifies this. When scrapping your entire vehicle, an Authorised Treatment Facility (ATF) should be the go-to place, typically at no cost.

Hand over your log book to the ATF, retaining the yellow ‘sell, transfer or part-exchange’ section to send to the DVLA. A confirmation letter should arrive within approximately 4 weeks.

If you’re salvaging parts from the scrapped vehicle, declare it as off-road first. Subsequent steps remain similar to the above process.

Registering Your Vehicle as Off-Road

A vehicle not in use or slated for scrapping shouldn’t drain your finances with unnecessary tax or insurance. Register it as off-road via the Statutory Off Road Notification (SORN). The 11-digit reference number from your V5C or the 16-digit one from your vehicle tax reminder letter (V11) is essential to apply.

Taxing Your Vehicle

Taxing your car requires either a recent DVLA reminder letter or your V5C. For first-time taxing post-purchase, the green ‘new keeper’ slip from the log book is necessary.

Updating Vehicle Details

If there are changes to the vehicle, such as a colour alteration or modifications, the DVLA should be informed. Typically, the relevant section of the V5C must be completed and sent to the DVLA.

Changing Personal Details

Any change in your personal details, especially your address, requires an update in the V5C. Fill out the appropriate section and forward it to the DVLA.

Buying a Used Vehicle

When purchasing a pre-owned car, ensure the seller hands over the V5C. It’s essential to cross-check the details within to ensure you’re not inheriting any unforeseen issues.

Having a clear understanding of when and how to use your V5C will streamline many of the administrative processes associated with vehicle ownership, ensuring you remain compliant and up-to-date with all necessary regulations.

Updating personal information and changes to vehicle

The vehicle log book (V5C) isn’t just a passive document—it’s your communication channel with the DVLA regarding changes that could impact vehicle tax or even the legality of your vehicle on the road. Forget or delay these crucial updates, and you could be dishing out up to £1,000 in fines!

Modifying Personal Details

Changing Your Address or Name: DVLA strives to keep accurate records for every vehicle keeper. So, if you’ve moved homes or changed your name, it’s time to whip out your V5C.

For new-style log books (identified by multi-coloured numbered blocks on the front), jot down your updated address or full name in section 3. If yours is the older version, make the change in section 6. While at it, remember to also change the address on your driving license.

Got a name change not due to marriage or divorce, like through a deed poll? You’ll need to furnish proof. Send your updated log book, with any additional paperwork, straight to:

DVLA

Swansea

SA99 1BA

Vehicle Modifications and Adjustments

General Changes: Tinkered with your car recently? You might love those new mods, but the DVLA needs to be in the loop too. Depending on the changes, your vehicle tax could go up—or some mods might even be flagged as unsafe.

The common changes that require a V5C update include alterations to:

- Vehicle Colour

- Chassis or Body Shell (either replaced or modified)

- Cylinder Capacity

- Engine Specifications

- Fuel Type

- Seating Capacity

- Weight (particularly for large vehicles)

Specific Modifications Needing Inspection: Some changes might ring alarm bells at the DVLA, leading to possible inspections. Keep an eye out if you’ve made adjustments to:

- Body Type (like turning a van into a campervan)

- Chassis Number

- Motorbike Frame Number

- Wheel Configuration

- Vehicle Identification Number (VIN)

When updating your log book for these changes, make sure you gather all related evidence, as per DVLA guidelines. Depending on your modification type, there are two addresses for you to note:

For changes related to engine size, fuel type, weight of goods vehicle, or bus seating adjustments: DVLA Swansea SA99 1DZ

For every other type of change: DVLA Swansea SA99 1BA

After sending your log book and evidence to the DVLA, await their response. They might give you the green light, ask for an inspection, or even notify you about adjusted vehicle tax amounts based on your mods.

Keeping the DVLA in the Loop is Crucial

By promptly informing the DVLA about all relevant changes, you ensure you’re on the right side of the law, avoid potential fines, and ensure you’re paying the correct amount for your vehicle tax. It’s a win-win for everyone!

How do I apply for a new one?

Misplacing or never receiving your vehicle log book can be a real headache, especially since it’s so vital for tasks like taxing or selling your vehicle. Whether it’s buried under a pile of old papers or was never in your possession, here’s how to set things right.

By Phone

Quick Replacement:

If you’re the registered keeper of the vehicle and your log book has vanished or suffered damage, you can easily procure a replacement for a fee of £25. Simply dial the DVLA at 0300 790 6802. They’re open from Monday to Friday between 8am-7pm and on Saturdays from 8am-2pm.

A Little Caveat:

If there are updates needed for your name, address, or vehicle details, the phone option is a no-go. You’ll need to apply via post.

By Mail

Standard Replacement:

Start by downloading the V62 form, which is the application for a log book. Fill it diligently, attach a cheque or postal order for £25 payable to ‘DVLA, Swansea’, and forward it to:

DVLA

Swansea

SA99 1DD

If you didn’t receive a log book with your new vehicle

If you bought a vehicle but didn’t receive its log book, the process is somewhat similar. Fetch the V62 form, fill it out, and make sure you attach the green ‘new keeper’ slip you should’ve received upon purchase.

If this slip is MIA, brace yourself for another £25 fee made payable to ‘DVLA, Swansea’. The address remains the same:

DVLA

Swansea

SA99 1DD

Local Post Office to the Rescue:

For those residing close to a Post Office that processes vehicle tax, this is your lucky day! Hand in your V62 form and £25, and they’ll let you know on the spot whether you can tax your vehicle without the log book. Once approved, anticipate the arrival of your new log book by post in roughly 6 weeks.

Frequently asked questions

It’s not uncommon for official documents to take a bit of time to make their way to you. When it comes to log books, the DVLA typically dispatches them within a 6-week window. However, if that period elapses and your mailbox remains empty, it’s advisable to take some proactive measures.

Remain Calm and Patient: First and foremost, remember that mail delays, although frustrating, can occur for a myriad of reasons including high application volumes, postal service backups, or unforeseen circumstances at the DVLA’s end.

Contact the DVLA:

- Via Phone: Reach out to the DVLA directly. Their customer service line at 0300 790 6802 is staffed with representatives who can provide insight into the status of your log book application. It’s possible there might be a backlog or some issues that they’re actively addressing.

- Via Email: If you’d rather not call, or if you’re trying to avoid potential wait times on the phone, the DVLA also offers an email service. This provides an easy way to submit your query and get a documented response.

Check Your Application Details: While you wait for a response, it’s worth reviewing any application receipts or confirmations you received. Ensure all provided details were accurate, especially your postal address. A simple typographical error can result in delays.

Stay Updated: If you’ve recently moved homes, make sure to check with your previous residence or ensure mail forwarding is activated. Sometimes, documents could be redirected there.

Keep a Record: Always maintain a record of all correspondence with the DVLA, whether it’s call logs or email threads. This will come in handy in case you need to reference past communications or if further complications arise.

Accuracy is paramount when dealing with official documents, and your vehicle log book is no exception. Supplying incorrect information on your log book isn’t just a simple oversight—it carries potential consequences.

- Financial Ramifications: One of the immediate concerns of submitting inaccurate details is the possibility of incurring a substantial fine. The DVLA enforces strict rules to ensure vehicle records are up-to-date and accurate. A mistake can cost you dearly, hitting your pocketbook when you least expect it.

- Administrative Hassles: Incorrect details can lead to potential administrative complications. You may find yourself entangled in lengthy processes to rectify errors, requiring additional forms, evidence, or even appointments.

- Impacts on Transactions: If you’re looking to sell, trade, or otherwise transfer ownership of your vehicle, having a log book with incorrect information can stall or even jeopardize the transaction. Buyers or official entities might be reluctant to proceed if they notice discrepancies.

- Tracking Issues: The DVLA relies on accurate records for several purposes, including tax, insurance, and vehicle recalls. Incorrect information can disrupt these processes, potentially leading to more serious consequences down the line.

Corrective Measures: If you’ve spotted an error on your log book or realize that it doesn’t reflect the latest details, it’s essential to take corrective action promptly. Applying for a replacement log book ensures that the DVLA’s records align with your current circumstances.

Moreover, it demonstrates your commitment to compliance, possibly mitigating any potential issues stemming from the oversight.

Understanding the distinctions between old and new style log books is essential for accurate record-keeping and ensuring smooth interactions with the DVLA.

While both versions serve the same fundamental purpose – to certify the registered keeper of a vehicle – they do present some differences in design and layout.

- Visual Appearance: At first glance, the most noticeable difference is the aesthetic design. New style log books come equipped with multi-coloured numbered blocks on the front cover, offering a more vibrant and contemporary look. In contrast, the older versions maintain a more subdued appearance without these coloured blocks.

- Layout and Sections: Though both versions contain similar information, the arrangement or categorisation might differ. It’s crucial to read the headings and guidance provided within each section to ensure you’re completing the right part, especially if you’re familiar with one version and encountering the other for the first time.

- Updates and Enhancements: The new style log book might incorporate improved security features, making them harder to forge. They could also have clearer instructions or user-friendly layouts, resulting from feedback on the older version.

- Transition: It’s worth noting that while both types of log books remain valid, as older versions phase out and get replaced, the majority of vehicle owners will eventually hold the new style log book.

- Importance of Attention to Detail: Regardless of the version you possess, accuracy is paramount. While the styles might differ, the importance of the information within remains consistent. Therefore, even if you’re unsure about the version you have, paying close attention to the sections you’re completing will ensure you relay the correct information.

Yes, while the vehicle log book (V5C) streamlines the process of scrapping a car, it’s not the sole means of doing so. If you find yourself in a situation without your V5C, there are still avenues you can pursue to scrap your vehicle legally and responsibly.

- Using an Authorised Treatment Facility (ATF): Always ensure you’re using an ATF when scrapping your vehicle. These facilities are licensed by the environment agencies to safely dispose of vehicles, ensuring that harmful components are handled responsibly.

- Notification to DVLA: It’s crucial that the DVLA is informed once you’ve scrapped your car to avoid any future liabilities, especially if you don’t have the V5C. To notify the DVLA:

-

Letter Details: Draft a letter indicating that you’ve scrapped your vehicle. The details you should incorporate include:

- Vehicle registration number

- Date of sale or scrapping

- Make and model of the vehicle

- Name, address, and possibly the license number of the ATF or scrap yard.

-

Sending the Letter: Address the letter to:

DVLA

Swansea

SA99 1BD - Get a Certificate of Destruction: Though not a direct replacement for the V5C, some ATFs might provide you with a Certificate of Destruction. This document serves as proof that your vehicle has been scrapped and de-registered, ensuring you’re no longer accountable for it.

- Avoiding Potential Penalties: Neglecting to inform the DVLA could result in fines or continuous vehicle taxation. Even if you no longer possess the vehicle, you might still be held responsible for it if the DVLA isn’t notified of its scrapping.

- Retaining Records: Always keep copies of any correspondence with the DVLA and receipts or documentation from the ATF. This can be crucial if any disputes arise or if you need to prove the vehicle’s scrapping at a later date.

The vehicle log book, or V5C, is a crucial document when it comes to selling your vehicle.

It provides proof of ownership and is a testament to the vehicle’s history. However, what happens if you’ve misplaced this key piece of paperwork?

- Importance of the V5C: The V5C log book serves multiple purposes. Firstly, it confirms the vehicle’s registered keeper, which may not necessarily be the owner. Secondly, the green ‘new keeper’ slip (also known as the V5C/2) allows the new owner to temporarily prove they’ve taken over the vehicle until they receive a new V5C.

- Using the 11-Digit Reference Number: The 11-digit reference number from the V5C is pivotal for the new keeper. It’s this number that the buyer will use to notify the DVLA of the change in ownership. Without it, the transition can become complicated.

- Applying for a New V5C: If you’ve lost your V5C or it’s been damaged, it’s imperative to apply for a replacement before selling your vehicle. This ensures a smoother handover process and provides the buyer with necessary assurance. To apply:

- Download and complete the V62 form from the DVLA’s website.

- There’s a fee of £25, which can be paid via cheque or postal order payable to ‘DVLA, Swansea’.

- Mail the form and payment to: DVLA, Swansea, SA99 1DD.

- Time Considerations: Receiving a replacement V5C can take up to 6 weeks. If you’re considering selling your vehicle soon, it’s wise to apply for a new log book well in advance to avoid delays or complications during the sale.

- Buyer’s Perspective: Many potential buyers might be wary of purchasing a vehicle without a V5C as it’s a red flag regarding potential ownership issues or unresolved financial ties. Having the log book in hand not only streamlines the process but also instills confidence in the buyer.

- Temporary Solutions: While waiting for a new V5C, if you have a potential buyer, it’s essential to keep open communication. Sharing the V62 receipt or any correspondence from the DVLA can provide some reassurance.

Renewing your car tax, also known as Vehicle Excise Duty (VED), is a straightforward process but requires specific documentation to ensure its smooth execution.

- Preferred Documents: When the time comes to renew your car tax, you would ideally either have:

- A reminder letter (V11): This is sent by the DVLA to remind registered keepers that their car tax is due for renewal.

- Your vehicle log book (V5C): This essential document provides proof that you are the registered keeper of the vehicle. The V5C contains crucial information such as the vehicle’s registration date, details about the vehicle, and the name and address of the registered keeper.

- Misplaced Your Documents? If neither the reminder letter nor the log book is on hand, fret not! There’s a solution:

- You can apply for a replacement V5C log book using the V62 application form. The process involves downloading and filling out the V62 form.

- After completing the V62 form, you can visit a Post Office branch that deals with vehicle tax. The helpful staff there will assist you in both applying for a replacement log book and sorting out your car tax. Remember, there might be a fee involved for the replacement.

- How Long Does it Take? It’s worth noting that receiving a replacement log book can take up to 6 weeks. Therefore, if you know your tax is due soon and you’ve misplaced your V5C, it’s prudent to start the replacement process early to avoid potential penalties.

- Digital Alternatives: The DVLA also provides digital services, allowing registered keepers to tax their vehicles online. In most cases, if you’ve received your V11 reminder, you can use the unique 16-digit reference number on it to renew your tax online. This online method can be a lifesaver if you’ve misplaced your V5C.

- Importance of Timely Renewal: Always ensure that you renew your vehicle tax on time. Driving without valid tax can lead to significant fines and potential clamping of your vehicle.